Piecewise

Application

Few real-life, practical situations can actually be modeled by the same function over the course of the entire time it is modeling. This brings cause for studying piecewise functions. For example, a piecewise function can represent "graduated" income tax versus a flat tax rate. A flat income tax would tax people at the same rate regardless of their income, for instance a flat tax of 30% of your income. Some people think that flat tax is unfair for those in or near the poverty level because they are getting taxed at the same rate as those in a higher income bracket. Our income tax is based on a graduated tax calculation. In a graduated tax system, the first $15,000 you earn may be taxed at a rate of 20%, the next $45,000 you make may be taxed at a rate of 25%, and any more money that you make above $45,000 could be taxed at a rate of 35%.

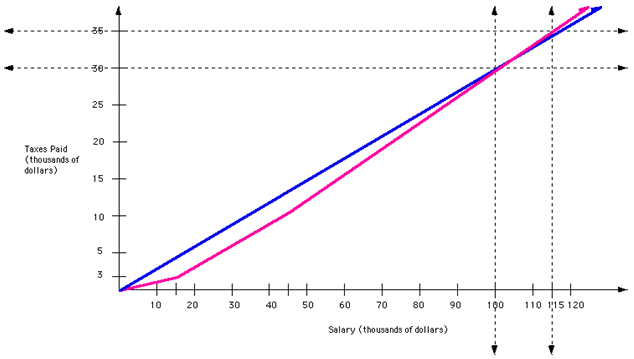

Below is a graph of this situation:

The graph in pink represents the graduated tax and is a piecewise function. It is a continuous piecewise function created by three different linear functions. Notice the change in slope when x = 15,000 and again when x = 45,000.

The graph in blue represent the flat tax and is not a piecewise function. Notice that it has a constant slope.